The World Of Printers— An Overview of The Global Printer Market

Posted by Rob Errera on 01/17/2023

A look at the global printer market reveals one simple fact — printers aren’t going away.

Sure, they’re used less frequently as office paperwork gets digitized, but printers and copiers still play a vital role in business and education.

An overview of the global printer market shows the $9.7 billion industry is still growing, albeit slowly, with an expected annual growth of 0.78% through 2027.

Printers and Copiers Around the World

Printers, copiers, and fax machines are grouped as “hardcopy peripherals” for market analysis purposes here.

Who Has The Biggest Share Of The Printer Market?

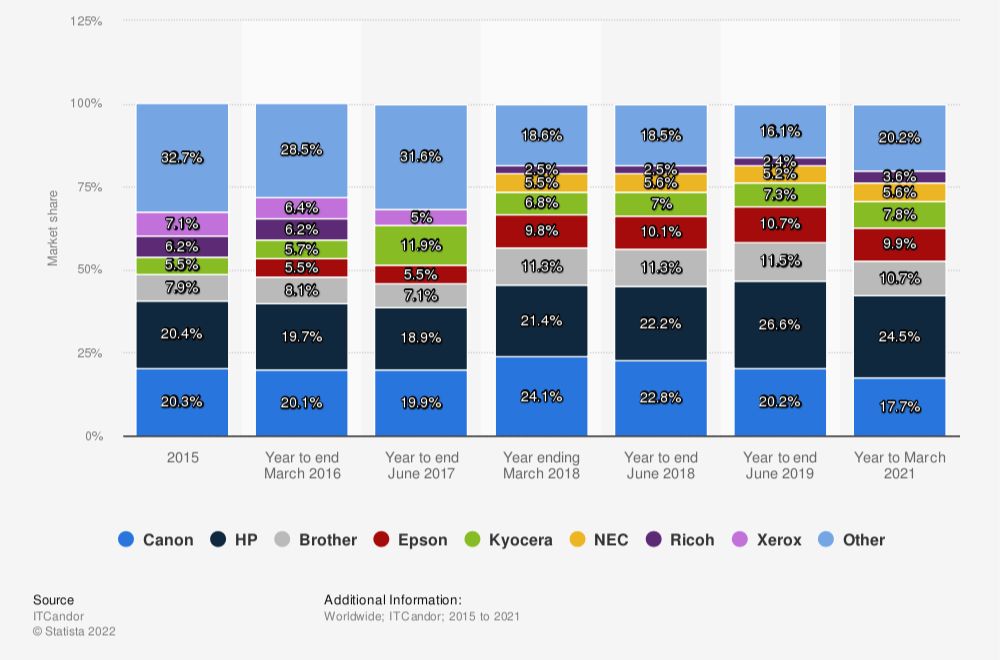

According to Statista's analysis of 2021, HP still holds the top slot with 24.5% of the market. Canon is the next highest, with a 17.7% share.

Brother checks in with 10.7% of the market, while Epson claims 9.9%. Kyocera owns 7.8% of the market, NEC holds a 5.6% share, and Ricoh claims 3.6% of the printer market worldwide.

That leaves a little over 20% of the printer and copier market being serviced by other brands, like Xerox, Sharp, Panasonic, and Samsung.

Printer Share by Vendor Worldwide from 2015-2021

Printer and Copier Global Market Share, 2021

- HP 24.5%

- Canon 17.7%

- Brother 10.7%

- Epson 9.9%

- Kyocera 7.8%

- NEC 5.6%

- Ricoh 3.6%

Five-Year Market Analysis

Let’s compare these 2021 numbers to 2016 figures. Five years ago, Canon held the top slot with 20.1% of the market, followed closely by HP with 19.7%.

In 2016, Brother held 8.1% of the market, Epson 5.5%, and Kyocera 5.7% of the market.

Ricoh had a 6.2% share of the worldwide printer and copier market, while Xerox held 6.4%.

Over a quarter of the printer market, 28.5%, was divided among other brands.

What's changed in the printer and copier market in the last five years?

Big players, like HP and Brother, got bigger, gobbling up more of the marketplace, and squeezing out established brands like Xerox and Panasonic.

Smaller brands continue to scramble for a piece of the printer market pie. NEC, which fell under the "other" umbrella in 2016, has managed to carve out a respectable 5.6% of the market by 2021.

By contrast, the established brand Ricoh has lost nearly half its market share over the last five years, dropping from 6.2% in 2016 to 3.6% in 2021.

How Many Printers Were Sold Last Year?

Statista reports 94.4 million printers and copiers were shipped in 2020.

This is down from a 2008 peak of 127.11 million units shipped but still represents revenue growth of 11.6%.

Printer and copier revenue in 2021 topped $10.78 billion.

What Does a Printer Cost?

The price of printers and copiers has slowly dropped over the past 10 years.

In 2014 the average printer was $100.50, in 2022 the average printer sells for $97.51. By 2027 that number is expected to drop to $94.93.

Global Shipments of Hardcopy Peripherals from 2008-2020 (in Million Units)

Printers and copiers are classified as “hardcopy peripherals” by those who track sales and shipments.

Hot Market: 3-D printers

By far, the fastest-growing printer market is for 3-D printers.

The 3-D printer market reached a value of approximately $17.4 billion in 2022 and is expected to increase to $37.2 billion by 2026.

Printers Market Breakdown by Country

The global printer market is valued at around $45 billion in 2022, and is forecasted to grow at a rate of 6% during the period 2022-2028.

Global Printer Market Revenue Historic Growth and Forecast from 2017 -2028 (in Billion US Dollars)

In 2028 it is expected to reach a market size of ~US$ 65 billion, according to Ken Research Analysis.

This rise in growth, according to Ken Research, can be attributed to the progression of cloud-based printing services, the introduction of new products, and an uptick in the number of small and medium-sized businesses utilizing this technology.

Broken down by country the predictions look like this:

Printers and Copiers in the United States

The printer market in the United States will be valued at $1.35 billion in 2023.

- 11 million printers and copiers will be sold in the U.S. by 2027.

- The printer and copier industry in America is expected to grow - by 0.2% in 2024.

Printers and Copiers in Germany

The printer and copier industry in Germany generated $533 million in 2023.

- The market is expected to shrink by 0.16% annually through 2027.

- 3.7 million printers will be sold in Germany by 2027.

Printers and Copiers in Brazil

The printer and copier industry in Brazil generated $474 million in 2023

- The market is expected to grow by 0.96% annually through 2027.

- 4.4 million printers will be sold in Brazil by 2027.

Printers and Copiers in India

The printer and copier industry in India generated $437 million in 2023.

- The market is expected to grow annually by 1.13% annually through 2027.

- 11.2 million printers will be sold in India by 2027.

Printers and Copiers in China

China is the largest market for printers and copiers in the world.

- $2.29 billion in revenue was generated in 2023.

- 23.3 million printers will be sold to China by 2027.

- The printer market in China is expected to grow by 1.7% in 2024.

- The market is expected to grow annually by 0.83% through 2027.

Printers and Copiers in Belgium

The printer market generated $38.7 million in 2023.

- 300,000 new printers and copiers will be sold in Belgium this year.

- The market is expected to grow - by 0.9% in 2024.

Printers and Copiers in Canada

The printer market in Canada generated $197.9 million in revenue in 2023

- 1.4 million printers will be sold in Canada this year.

- The market is expected to show zero growth in 2024.

Printers and Copiers in the United Kingdom

The printer market in England is valued at $180.7 million in 2023.

- The market is expected to shrink by 1.23% annually through 2027.

- 60% of households in the UK own a printer or a copier.

- 1.1 million printers and copiers will be sold in the UK this year.

Printers and Copiers in Japan

Many leading printer manufacturers, such as Epson, Kyocera, Konica Minolta, Ricoh, and Canon are headquartered in Japan.

- $3.8 million in revenue was generated by Japanese printer sales in 2023.

- The Japanese printer market is expected to shrink by -0.41% between 2023 and 2027.

Printer Market Breakdown by Brand

Let’s take a look at the top printer brands.

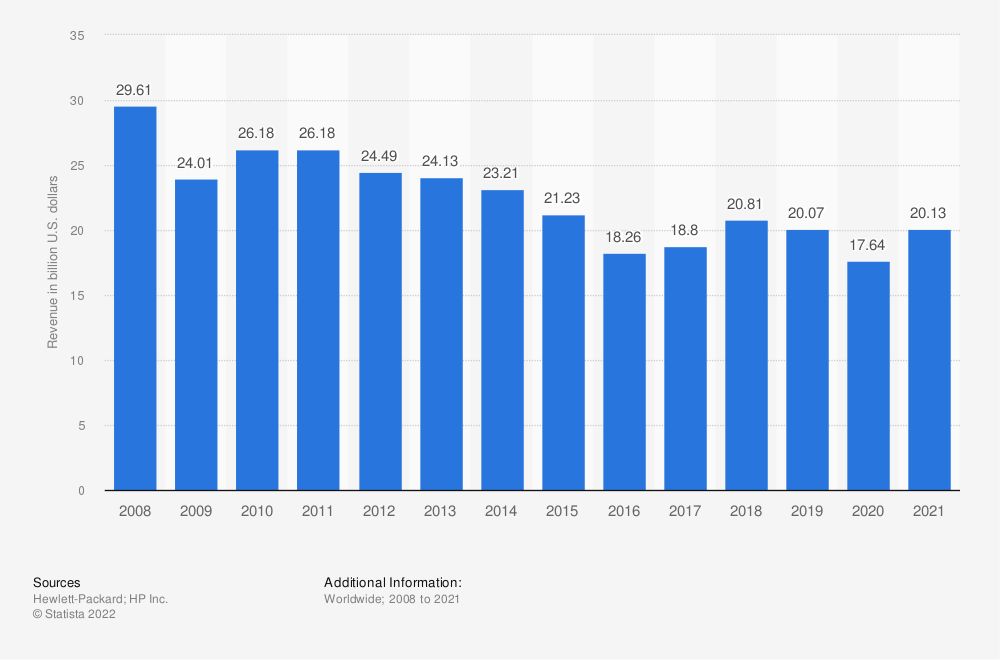

HP

In 2021, HP was responsible for 24.5% of global printer shipments.

HP‘s market share has increased by over 4% compared to the same period in 2018. HP continues to lead the market for large-format, printers.

The company generated printer and copier revenue of $20.13 billion in 2021. In 2020, HP held 41.2% of the printer and copier market worldwide.

Hewlett Packard's Net Revenue From Printing Segment from 2008-2021 (in Billion US Dollars)

Canon

In 2021 Canon reported net sales of around $30.55 billion, representing an 11.2% increase in net sales and an 18.3% increase in gross profit.

Brother

Brother posted annual revenue of $5.74 billion in 2021, down from a high of $6.9 billion in 2015. The company posted a gross profit of $2.6 billion in 2021, down from $3.1 billion in 2015.

Xerox

Xerox generated approximately $7 billion in revenue in 2021. According to macroaxis.com, Xerox has a 51% chance of filing for bankruptcy in 2023.

Epson

Epson posted revenue of $9.4 billion in 2021. The company claims it has sold 70 million EcoTank printers worldwide.

Ricoh

Ricoh’s digital services, which includes its imaging department, accounted for 66.9% of the company’s sales in 2021. Ricoh sales in 2021 were $13.3 billion.

Dell

Dell doesn’t sell many of its own brand of printers anymore, focusing instead on offering printers from Epson, Canon, and Xerox on its website.

The company stopped selling printers in 2016 and stopped honoring warranties on its printers and copiers in 2021.

Konica Minolta

Konica Minolta generated $7.4 billion in revenue in 2022. The company’s managed print services division is up 2% from last year.

Kyocera

The company posted sales of $1.8 million in 2022, and its managed print services division is up 7.1% from last year.

Oki

Oki components and platforms division posted sales of $1.47 billion in 2022. The company’s managed print services division is down 19.1%.

The below graphic gives a detailed view of the positioning of these companies over time.

Market Share Held by Hardcopy Peripherals Vendors Worldwide from 2009-2020

A Final Word on Printers and Copiers

Hardcopy peripherals, like printers and copiers, are steady sellers, but the market is relatively flat, with not much room for growth. (The exception to this is the $13 billion 3D printing industry, which is expected to grow by a rate of 17% over the next year.)

To combat the flat marketplace, many traditional printer and copier manufacturers are turning to “managed print services” and other subscription services to generate revenue.

Further Reading:

- Paper Books vs eBooks Statistics, Trends and Facts [2023]

- Eye-Popping Book and Reading Statistics [2023]

- UPDATE: HP Again Hikes Prices On Printers, Ink & Toner

Sources

- https://www.action-intell.com/2022/06/07/a-mixed-quarter-for-oems-as-supply-chain-woes-and-shortages-take-a-bite-out-of-revenue-and-profits

- https://www.itcandor.com/printer-q121/

- https://www.statista.com/outlook/cmo/consumer-electronics/computing/printers-copiers/worldwide

- https://www.macroaxis.com/invest/ratio/XRX/Probability-Of-Bankruptcy

- https://www.kenresearch.com/business-research/global-printer-market-outlook-2028/

- https://www.therecycler.com/posts/epson-publishes-q4-and-fy-results/

- https://www.businesswire.com/news/home/20221030005043/en/KYOCERA-Announces-Consolidated-Financial-Results-for-Six-Months-Ended-September-30-2022

- https://www.therecycler.com/posts/oki-releases-latest-financial-results-2/

Calculating arrival date

Calculating arrival date